Retail giant JC Penney recently embarked on a bold new way of doing business. And like other pioneers, such as Everest explorers, Oregon Trail immigrants and that poor monkey we shot into space, they’re finding that being on the cutting edge can be a precarious position.

In January, JC Penney’s new CEO, Apple expat Ron Johnson, announced that the retailer was implementing a number of sweeping changes to make the company more nimble, competitive and profitable. The first and most dramatic change: a new pricing strategy designed to put an end to over-discounting. Discounts and sales litter the retail landscape. JC Penney studied their sales and found that only one in 500 items sold at full price, while 72% of revenue came from products discounted by 50% off or more. To break through the discount clutter, JC Penney announced its new strategy, called “fair and square” pricing.

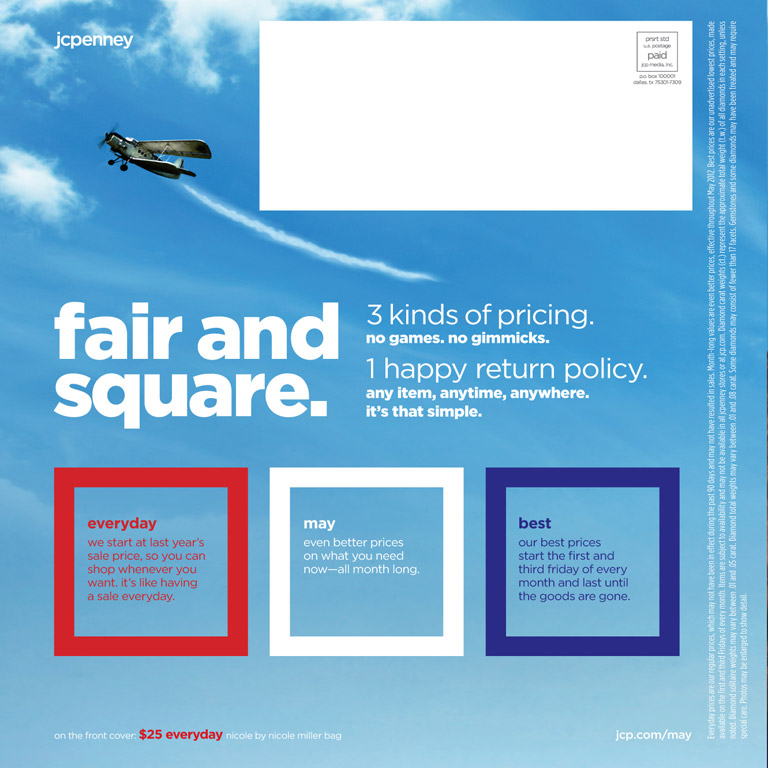

Penney cut prices by 40% across the board, rounded prices off to the nearest dollar (so, a shirt for $12 instead of $11.99) and announced that henceforth, there would only be three kinds of prices: everyday, regular prices; month-long values; and best prices, offered on the first and third Fridays of every month to coincide with paydays.

To promote the new pricing model, JC Penney launched an integrated marketing campaign across TV, direct mail, print and web. The first ads in the campaign featured the tagline “Enough. Is. Enough” and illustrated the coupon and discount overload that regularly deluges consumers. In a TV spot, consumers shriek at the sight of coupons, sale signs and junk mail; another, starring new brand spokesperson Ellen DeGeneres, travels back to the West to find a time without coupons. Later ads in the campaign, created to promote month-long specials and other new offerings, were inspired by illustrations in The Saturday Evening Post and are filled with warmth, energy and bright colors.

Despite the well-done campaign and the appeal of the fair pricing idea—aren’t we all a little sick of the endless “deals”?—the pricing shift is off to a shaky start. JC Penney lost $163 million in the first quarter of the year. Sales dropped by 20%, traffic shrank by 10% and average customer spending slipped by 5%. JC Penney is sticking with the new pricing strategy. Said Johnson during a presentation for analysts and investors, “The transition has been tougher than anticipated, but the transformation is ahead of schedule. Our customer is clearly buying less with fewer visits in the short term, but we want to earn her back, earn him back.” But the verdict is still out. Will JC Penney’s customers embrace the fair pricing model, or will the allure of the deal prove too much to overcome?

Let’s explore some points and counterpoints and try to predict how the pricing shift will shake out. There are some reasons to believe that JC Penney’s new vision will come true—and also some evidence that this idea just won’t take hold.

Good Idea

First, it’s too soon to proclaim the new pricing model dead. Many analysts are giving JC Penney more time to explain fair pricing to their customers and implement other changes, like the stores-within-a-store. AdAge quotes Paul Swinand, a Morningstar analyst, as saying, “Although we’ve previously stated that the turnaround would take time, today we are even more impressed by how quickly the company is moving in its transformation.” Consumers are so immersed in the constant sale and discount environment that it’s going to take some time to change their mindset. JC Penney plans to revamp some ads to educate consumers about fair pricing and its value, like this creative that shows how a dress that would have been $24.99 after a discount and coupon last year costs $25 this year.

Bad Idea

JC Penney faces a greater challenge than simple education. The fair pricing model runs counter to a lot of what we know about the psychology of pricing. The draw of the deal is very powerful. People feel good about saving money. We get greater satisfaction when we feel like we’re getting a bargain, even if we’re really spending more money than we’re putting back in our wallets. For some consumers, getting the deal has become like a sport, with the deal hunters on the TV show Extreme Couponing serving as an extreme example.

The concept of anchoring also plays into the allure of the deal. Anchoring describes when we rely too heavily one piece of information to make a decision, and a suggested retail price is a prime example. If a t-shirt tag tells us that the shirt was originally priced at $24.99 and is now marked down to $17.99, the lower price seems like a great deal—even if that shirt only cost $3.99 to make. JC Penney’s everyday prices don’t give us anything to compare against. We like to think of ourselves as rational consumers, but without a comparison point, do we really know what we should pay for a v-neck pocket tee?

Penney’s new strategy of rounding prices to the nearest dollar also goes against pricing psychology. Prices with a 9 at the end are viewed as a value, while prices with a 0 at the end are seen as premium products. With all these cognitive factors working against JC Penney’s fair pricing, is it likely that a few fun ads are going to win over customers?

JC Penney’s offerings simply don’t stand out enough to overcome these psychological disadvantages. A t-shirt sold by JC Penney is seen as the same as a t-shirt from Kohl’s or Walmart or Old Navy. And if those places are offering deals for the same basic products, that’s where consumers are going to go.

Good Idea

Differentiation is a fair point. And JC Penney is working to offer products with appeal beyond a good price. Special collections from designers Cynthia Rowley, Betsey Johnson, Vivienne Tam and Lulu Guinness will appear in stores this fall. A Martha Stewart shop will be the focal point of a home section, with Jonathan Adler, Michael Graves and Bodum also getting a footprint. More space will also be given to popular brands like Puma and Nike, and a new JCP label will launch in August. If JC Penney can draw people in with these offerings, they’ll be able to compete on more than price alone.

Differentiation in general is at the heart of the changes JC Penney is trying to make. The new pricing model, new marketing campaign, stores-within-a-store and other changes are all aimed at setting JC Penney apart from their retail competitors. If JC Penney stuck with the same old sales and promotions, they would be back in the heap with everyone else, promoting deeper and deeper discounts to lure deal-saturated consumers through their doors. Yes, the fair pricing model and other changes are risky. But is continuing on the promotions path any less risky?

Verdict

We think if JC Penney can set themselves apart with both products and image, they could carve a great niche for the company in the retail world. They also need to continue to refine the marketing campaign to explain the pricing model and continue to open customers’ eyes to the headaches of discount overload. If JC Penney can strike an emotional chord to counter the lure of the discount, this transformation stands a chance.